Case Study

Digital Innovation in CFPB Education Programs

Empowering Consumers Through Streamlined Digital Resources and Strategic Partnerships

The client

Consumer Financial Protection Bureau

Content and Product Audit and Strategy

Challenge

The Consumer Financial Protection Bureau (CFPB) sought to enhance its financial education portfolio to serve better its mission of empowering consumers to make informed financial decisions. To achieve this, through the Measure and Maintain (MM) 3.0 Support Services, Flexion conducted a comprehensive content and product audit. This project aimed to identify which products should be retired, sustained, or grown and to develop a strategic roadmap to guide future enhancements.

The CFPB sought to modernize its financial education portfolio by addressing key challenges:

- Vast and Fragmented Content: Over 70,000 URLs with deeply nested content created a disorganized user experience.

- Duplicate Resources: Widely duplicated content, including over 4,000 duplicate PDFs, diluted SEO authority and user trust.

- Maintenance Burdens: Outdated, fragmented resources significantly increased the cost of maintaining a cohesive digital presence.

- Evolving Consumer Needs: Rapidly changing financial landscapes demanded adaptive, real-time content strategies to remain relevant.

Our approach

Content and Product Audit

The audit process began with a thorough evaluation of CFPB’s financial education products using a scoring system that assessed unique value, reach, engagement, impact, and maintenance burden. The audit methodology included:

- Quantitative analysis of user engagement metrics

- Qualitative assessment of content relevance and accuracy

- Stakeholder interviews to gather internal perspectives

- Competitive analysis of similar financial education resources

Key findings revealed that several products, such as the Financial Well-Being Survey, showed high user engagement, indicating the need to sustain and invest in them. Conversely, the report recommended retiring underperforming products like FinEx because of their low impact and significant maintenance burdens.

As the team delved deeper into the evaluations, it became clear that there was a critical need to streamline CFPB’s content, particularly by consolidating fragmented resources and retiring outdated materials. This approach aimed to reduce redundancy, enhance user experience, and align digital resources with CFPB’s broader mission. The audit highlighted the importance of integrating high-performing resources across CFPB’s digital ecosystem to maximize their reach and impact.

Using AI to Enhance the CFPB’s Financial Education Portfolio

A key component of this project involved leveraging AI to enhance the CFPB’s financial education portfolio. The team leveraged a combination of natural language processing (NLP) algorithms, machine learning models for content classification, and custom-built web crawlers. By using open-source frameworks and AWS Bedrock, the team implemented these AI tools to analyze CFPB.gov and related .gov sites in a scalable and efficient manner. This allowed for the identification of thousands of pages of duplicate content, particularly PDFs that were widely replicated across the internet. This extensive duplication is detrimental for several reasons:

- SEO Impact: Duplicate content negatively affects search engine optimization (SEO) as it dilutes the authority of the original content and can lead to lower search rankings, making it harder for users to find authoritative sources.

- User Experience: When users encounter the same content within or across multiple sites, it can cause confusion and reduce trust in the information, leading to a fragmented user experience.

- Content Maintenance: Maintaining and updating content that exists in numerous locations significantly increases the maintenance burden. It also raises the risk of inconsistencies, as updates may not be uniformly applied across all instances.

The AI-driven analysis culminated in a comprehensive report provided to the CFPB, which included a strategy to collaborate with government partners to eliminate redundancy and convert PDF content into more accessible web content.

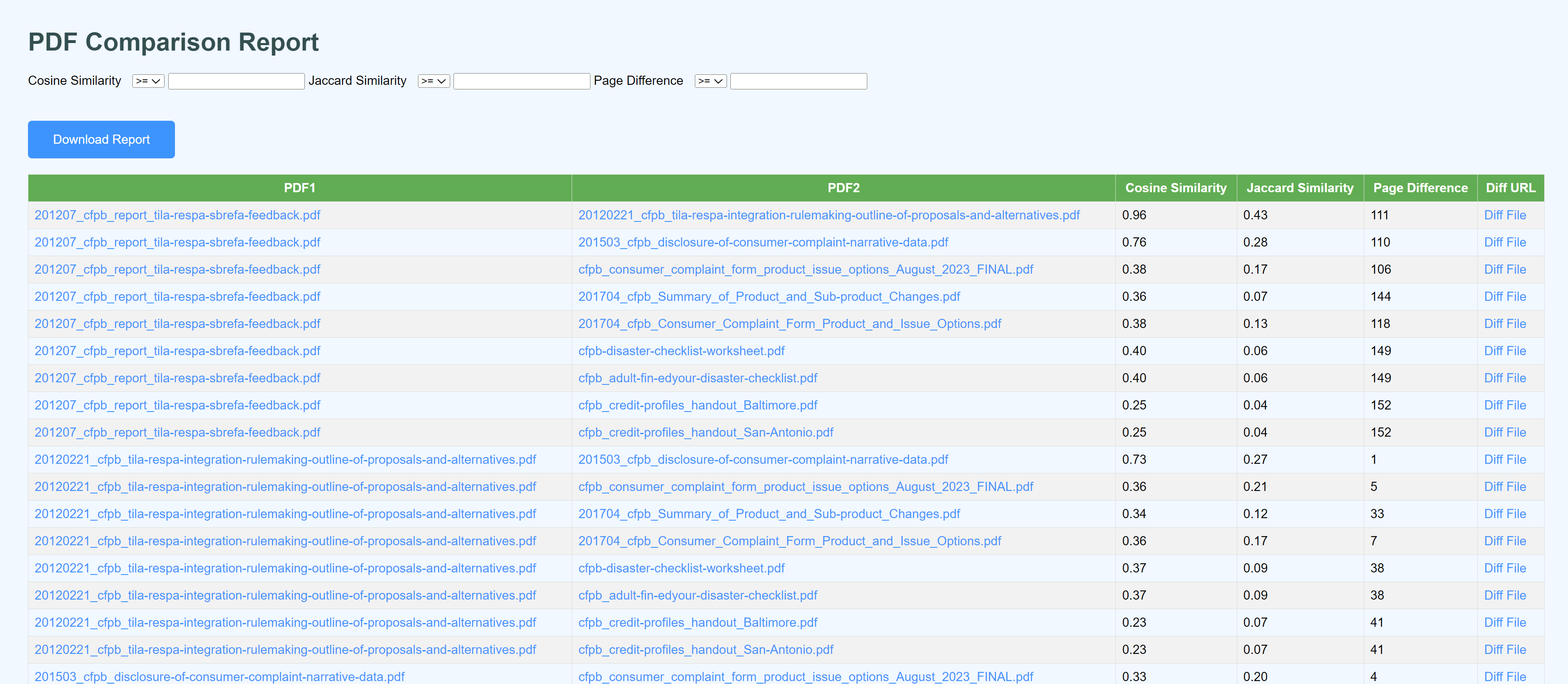

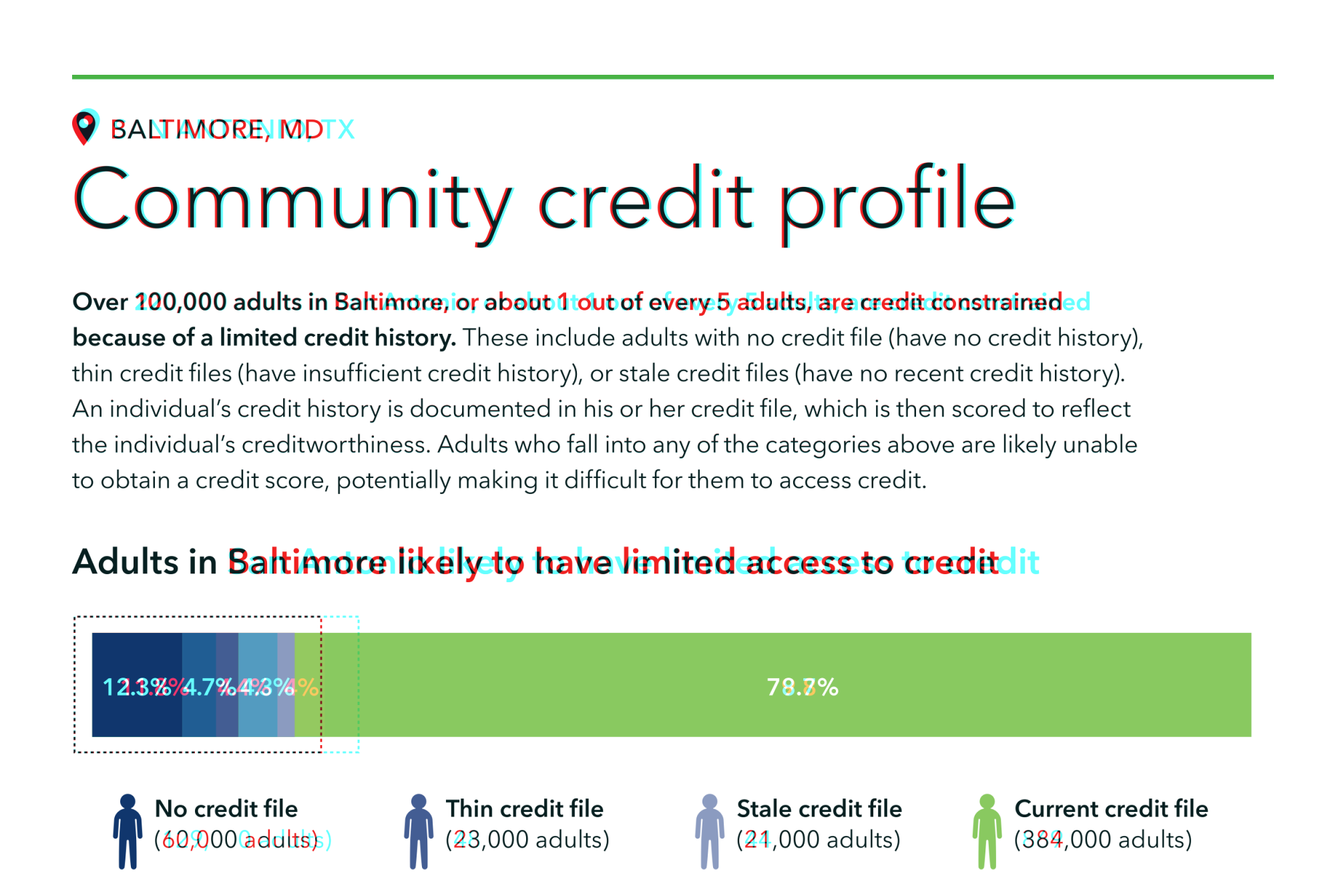

Image 1: An interface showing the duplicate files and various similarities and differences.

Image 2: An interface showing the duplicate files and various similarities and differences.

Additionally, AI was employed to conduct content comparative analysis and gap analysis using tools like ChatGPT. This enabled the team to identify gaps in the CFPB’s financial education resources and provided a foundation for targeted content development, ensuring that the portfolio remained comprehensive and user-focused.

Strategy Development

Building on the audit’s findings and AI-driven insights, the team outlined a comprehensive roadmap for CFPB’s financial education portfolio. The strategy emphasized a user-centric approach, recommending the adoption of dynamic content delivery mechanisms and enhanced search functionalities. This would allow the CFPB to maintain a fresh and relevant digital presence while reducing the burden of manual updates. Additionally, the strategy proposed reworking the information architecture to improve navigation and accessibility, ensuring that users can easily find the resources they need.

The strategy also addressed the need for a consistent user experience across all CFPB digital products. Standardizing design elements and navigation patterns would not only enhance brand consistency but also streamline content management efforts. Moreover, the team recommended expanding partnerships and exploring digital/interactive content opportunities to further extend the reach of CFPB’s financial education products.

Key Strategic Recommendations

Content Consolidation: Develop a content deprecation process

User Experience Enhancement: Create personalized learning pathways based on user profiles

Measurement and Optimization: Implement advanced analytics to track user journey and content effectiveness

Partnerships and Outreach: Develop a program for community outreach.

Roadmap Creation

The development of a strategic roadmap was a critical outcome of this project. The roadmap provided CFPB with a clear path forward, prioritizing actions that would yield the most significant impact. This included immediate steps like retiring low-performing content and elevating high-value resources, as well as longer-term initiatives such as implementing advanced search features and enhancing the overall user journey across CFPB’s digital platforms.

Technology stack

Outcomes

The content and product audit, coupled with the strategic roadmap developed for CFPB’s financial education portfolio, laid the foundation for a more effective and sustainable digital presence.

Short-Term Wins

Reduced Redundancy: Retired over 6,000 low-performing resources, including outdated PDFs.

SEO Improvements: Consolidated duplicate content, boosting organic traffic across high-priority pages.

Improved Accessibility: Converted static PDFs into dynamic web pages with translation and print capabilities.

Long-Term Benefits

Streamlined User Journeys: Proposed reorganizing content into intuitive pathways (e.g., “Panic vs. Plan Modes”) to guide users effectively.

Sustained Value: Created a scalable framework for CFPB to perform ongoing audits using AI tools and service design methodologies.

Enhanced Partnerships: Recommended collaborations with agencies like the SSA to ensure high-quality, cost-efficient tools for users.

By identifying key areas for improvement and providing actionable recommendations, this project not only aligned CFPB’s resources with its mission but also ensured that the Bureau could continue to empower consumers, including youth, with trustworthy financial education tools. The integration of AI-driven insights into the roadmap further solidified CFPB’s commitment to maintaining a dynamic and user-centered digital ecosystem.

Projected Outcomes

Content Maintenance Efficiencies: Flexion’s efforts eliminated approximately 75% of redundant content, including 4,000 instances of a duplicated PDF, reducing maintenance burden and improving user experience.

Reach and Accessibility: Enhancements in digital content structure and SEO are expected to enable CFPB to reach a significant proportion of additional users annually. By integrating youth education resources into platforms like Google Classroom, CFPB can potentially engage 500,000 new students annually, enhancing financial literacy among younger audiences.

SEO and Traffic Gains: The content audit identified 10% of high-performing pages that were under-leveraged. Optimizing these pages is projected to drive 20% more organic traffic.

Ready to change the way you’re doing business?

Contact us to talk about how Flexion can help your organization boost productivity.

A proud AWS partner.